Fringe benefit

Its refreshingly simple and a benefit for everyone. Instances where an employee exchanges cash wages for some other form of benefit is generally referred to as a salary packaging or salary.

New Changes To Fringe Benefits What S The Deal Strategic Benefits Solutions

Pre-Retirement Seminar Agenda - August 27 2022.

. Low interestinterest free loans. Tims employer provides him with a work car in the 2021 FBT year that is between 1 April 2020 and 31 March 2021. Regime fiscale e contributivo 2020-2022 Il decreto Aiuti bis ha elevato a 600 euro per il periodo dimposta 2022 il limite di esenzione fiscale e.

Vediamo come si calcola il fringe benefit con un esempio concreto. Consulta la tabella ACI fringe benefit. Noun an ornamental border consisting of short straight or twisted threads or strips hanging from cut or raveled edges or from a separate band.

Pay by instalments threshold. If the employees are covered for. See Publication 5137 Fringe Benefit Guide PDF or Publication 535 PDF for more information.

Free subsidised or discounted goods and services. The car is parked at premises owned or leased by or otherwise under the control of the provider usually the employer. Find out about fringe benefits tax FBT rates and thresholds for the 201819 to 202223 FBT years.

Fringe benefits tax rates and thresholds. Fringe benefits tax FBT Labels F1 F2 F3 F4 6A and 6B. Essi hanno lo scopo di quantificare i beni.

We offer products from the nations leading carriers and we are known for our full-service suite of tools and services that greatly reduce the burden of plan enrollment and administration. Car parking fringe benefits. Michigan Laborers Fringe Benefit Funds 6525 Centurion Drive Lansing MI 48917-9275 Phone.

Reinstatement of Inside Unemployment Benefits - September 27 2022. While companies may require some fringe benefits for all team members employers can also offer them to specific individuals as rewards. The FBT year runs from 1 April to 31 March.

Il fringe benefit o in italiano beneficio accessorio è un tipo di emolumento retributivo corrisposto a particolari categorie di lavoratori dipendenti riportato nella busta paga in aggiunta alla retribuzione Caratteristiche. Autoveicoli Benzina in produzione. It can include a variety of perks including.

FBT is separate from income tax. I fringe benefit sono elaborati dallArea Professionale Statistica alla quale si può fare riferimento tramite il seguente link per ulteriori informazioni o chiarimenti. Ecco cosa devi fare per il calcolo.

However you can use special rules to withhold deposit and report the employment taxes. La trovi sul sito ACI per scaricarle devi essere registrato al sito oppure sulla. Rate for 31 March 2019 to 31 March 2023.

With 100 vendors Fringe offers an employee lifestyle benefits experience that builds loyalty productivity and well-being. An FBT rate of 47 applies across these years. Esempio calcolo fringe benefit auto addebito dipendente.

La novità più importante è laumento per il 2022 del tetto di esenzione dei fringe benefit aziendali da 25823 a 600 euro oltre anche il raddoppio realizzato negli ultimi due anni. If you paid FBT of 3000 or more in the previous year you need to pay the tax quarterly by instalments with your business activity statement. Gli importi relativi ai fringe benefit 2022 sono stati pubblicati nella Gazzetta Ufficiale 307 del 28122021 ed integrati nella parte relativa ai veicoli a gasolio OUT nella successiva GU.

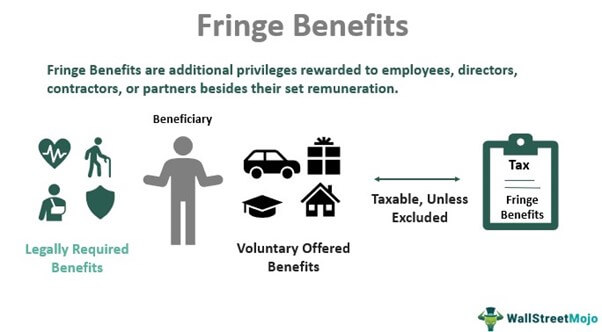

Employee benefits and especially in British English benefits in kind also called fringe benefits perquisites or perks include various types of non-wage compensation provided to employees in addition to their normal wages or salaries. A company phone or laptop. Some forms of additional compensation are specifically designated as fringe benefits in the Internal Revenue Code.

Generally assuming no other statutory exclusion applies the amount by which the fair market value FMV of the qualified parking fringe benefit exceeds the sum of the amount excluded from gross income under IRC 132a5 and the amount paid by the employee if any is wages subject to federal income tax withholding FITW Federal Insurance Contributions Act FICA tax and. In questo articolo trovi ancheFringe benefit. Fringe benefit tax FBT is a tax payable when the following benefits are supplied to the employees or shareholder-employees.

If they are taxable they should be included in wages on Form W-2 and subject to income tax withholding. Vacation Fund Service Charge Memo. - Benefit Office at 586 575-9200.

Working out amounts for income statements or payment summaries. Motor vehicles available for private use. Supponiamo che lauto sia una Alfa Romeo 4C 1750 Coupè.

The rules used to determine the value of a fringe benefit are discussed in section 3. Need To Call Us. 04 Apr 2017 QC 33675.

Fringe is the only benefit we offer that is used by every single employee. A fringe benefit is a form of pay including property services cash or cash equivalent in addition to stated pay for the performance of services. News How do I.

The reportable fringe benefit amount reflects the gross salary that you would have to earn to purchase the benefit from your after-tax income. Per ulteriori approfondimenti sul tema vedi i Riferimenti normativi. Sono state pubblicate nella Gazzetta Ufficiale n307 del 28-12-2021 le tabelle Aci valide per il calcolo dei fringe benefit per le auto assegnate per lanno 2022 ovvero la retribuzione in natura.

A fringe benefit is a benefit that an employee receives in addition to their regular salary. Autoveicoli Gasolio in produzione. If the recipient of a taxable fringe benefit is your employee the benefit is generally subject to employment taxes and must be reported on Form W-2 Wage and Tax Statement.

For more than 30 years Fringe Benefit Group has designed programs that simplify the benefits process for employers with hourly workers. A car parking fringe benefit will generally arise if an employer provides car parking to an employee and all the following conditions are satisfied. How are de minimis fringe benefits reported.

Learn more to get started. If the benefits qualify for exclusion no reporting is necessary.

Fringe Benefits Your Company Should Offer To Its Employees Benchmark Planning Group

Fringe Benefits 2019 Taxation Definition And Distribution In Itlaly

Fringe Benefits Rules For 2 S Corp Shareholders Cares Act Changes

Solution Fringe Benefit Tax Ppt Studypool

What Are Fringe Benefits Forbes Advisor

What You Need To Know About A Fringe Benefit Rate

What Are Fringe Benefits Clydebank Media

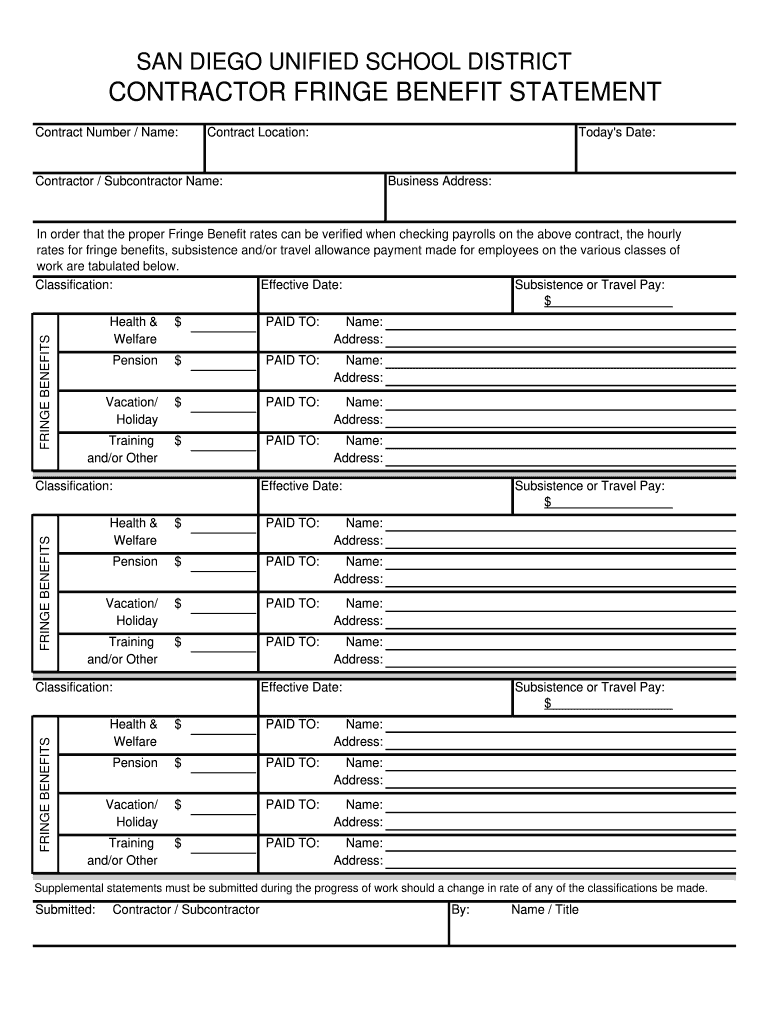

Fringe Benefit Statement 2021 Fill Online Printable Fillable Blank Pdffiller

Taxable Vs Nontaxable Fringe Benefits Hourly Inc

Fringe Benefits Meaning Tax Examples And Types

Top 12 Need And Importance Of Fringe Benefits Googlesir

What Are Fringe Benefits And Why Are They Important For 2019 Thestreet

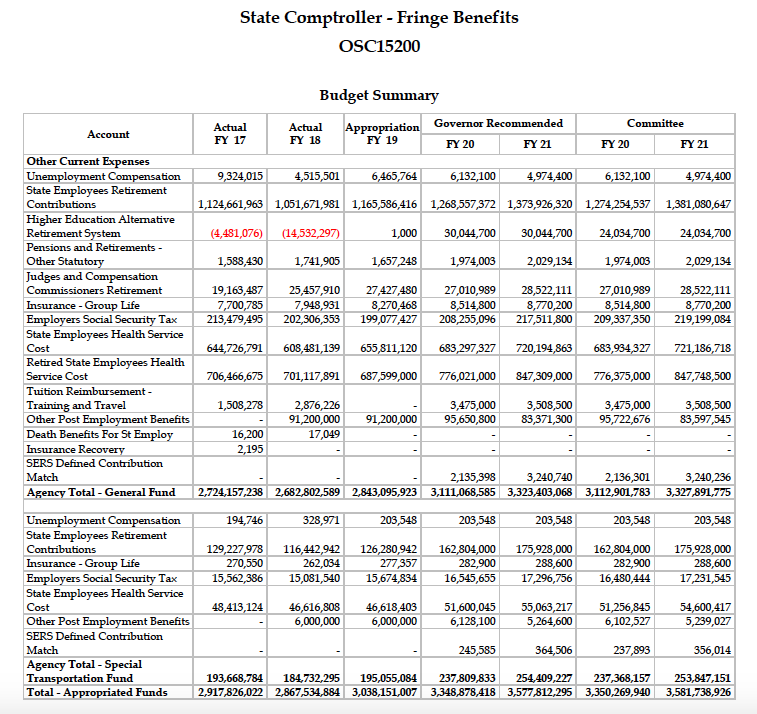

State Employee Fringe Benefit Costs To Grow 544 Million Over Two Years Yankee Institute

Importance Of Fringe Benefits Compliance Prime Blog

The Service Contract Act Fringe Benefits And Compliance Boon Group

Learn About Fringe Benefits Chegg Com